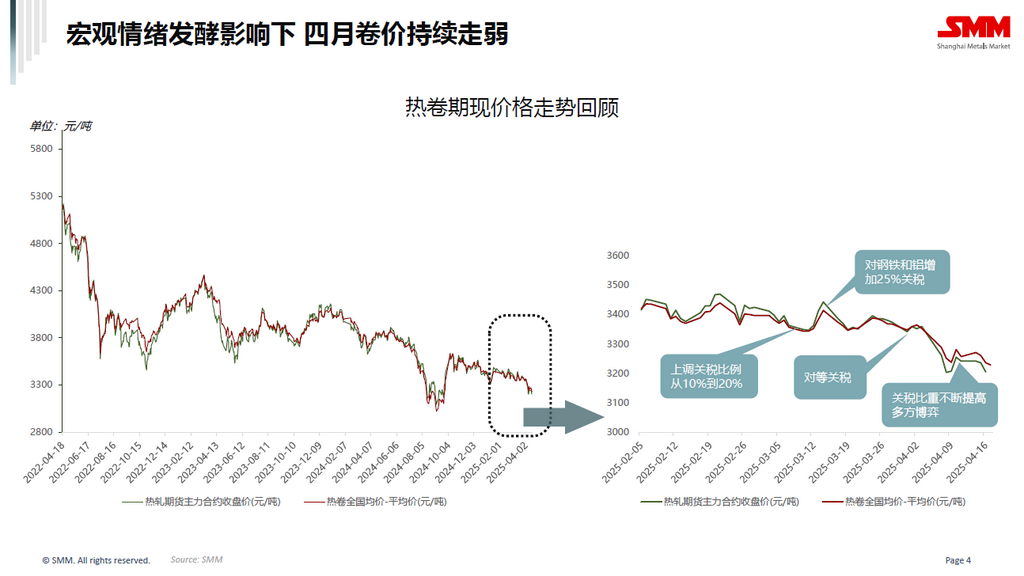

[SMM Hot Topic] Tariff Pressure Intensifies! Domestic Supply-Demand Imbalance? Where Is the HRC Market Heading Under Double Blows?

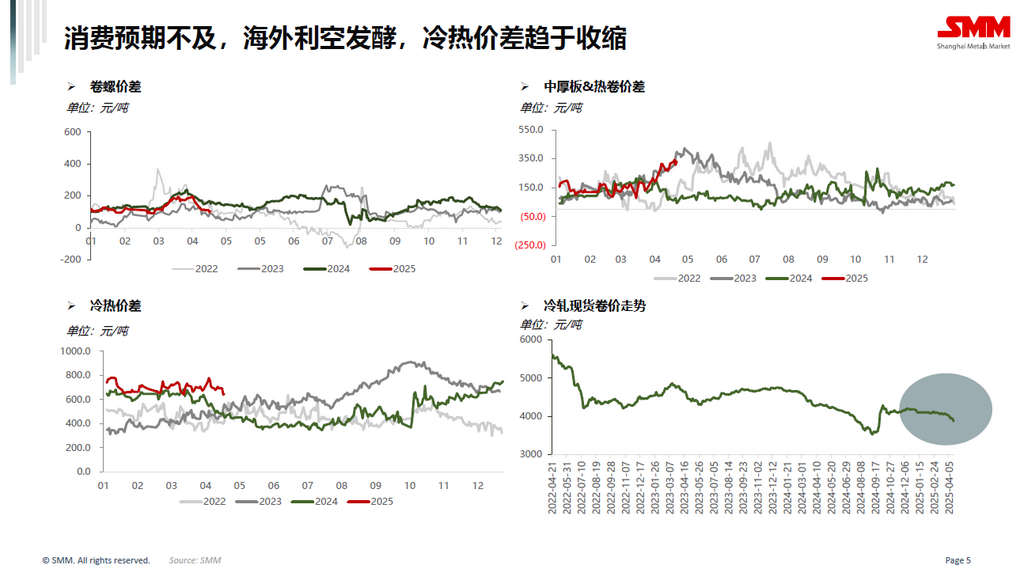

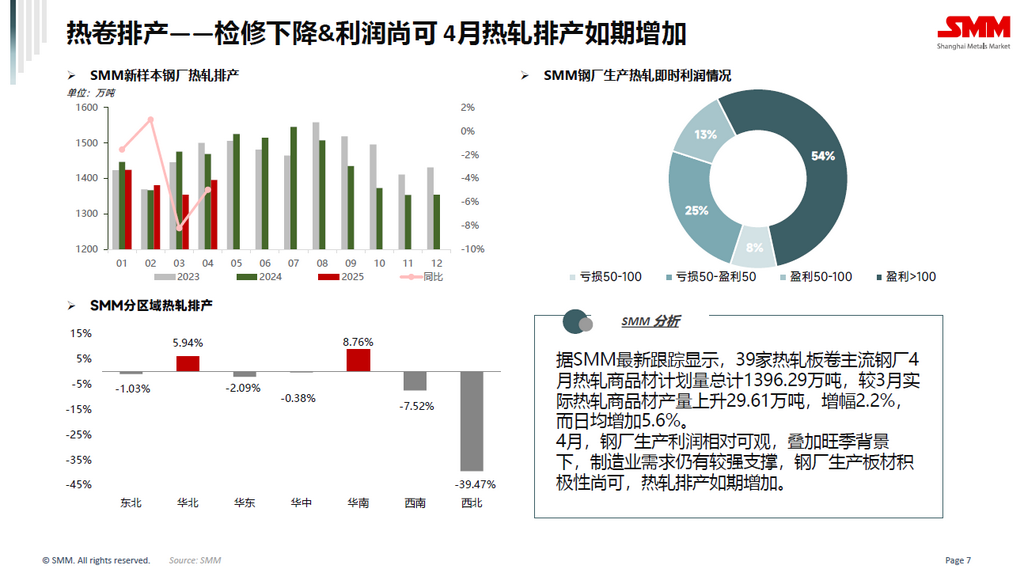

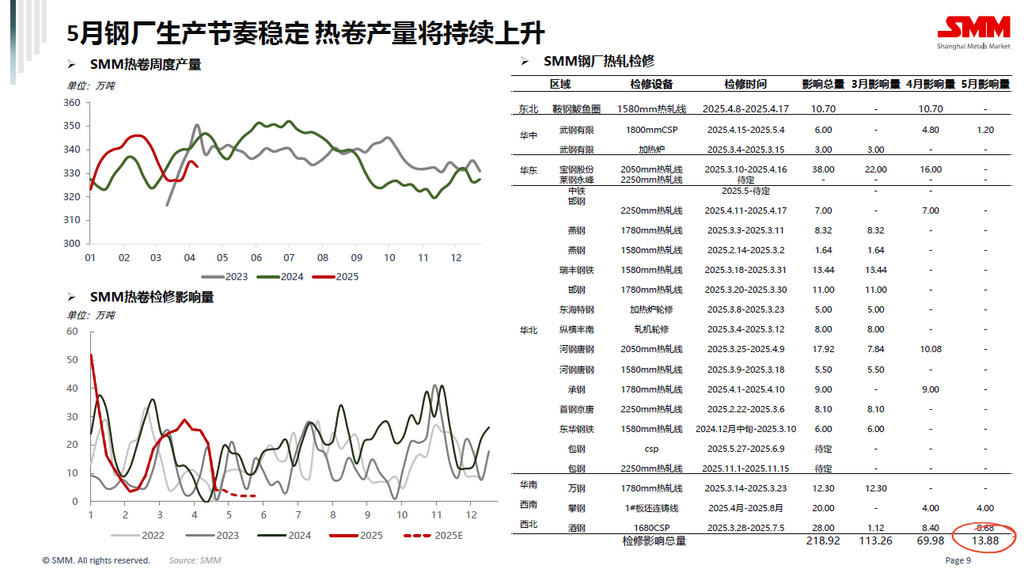

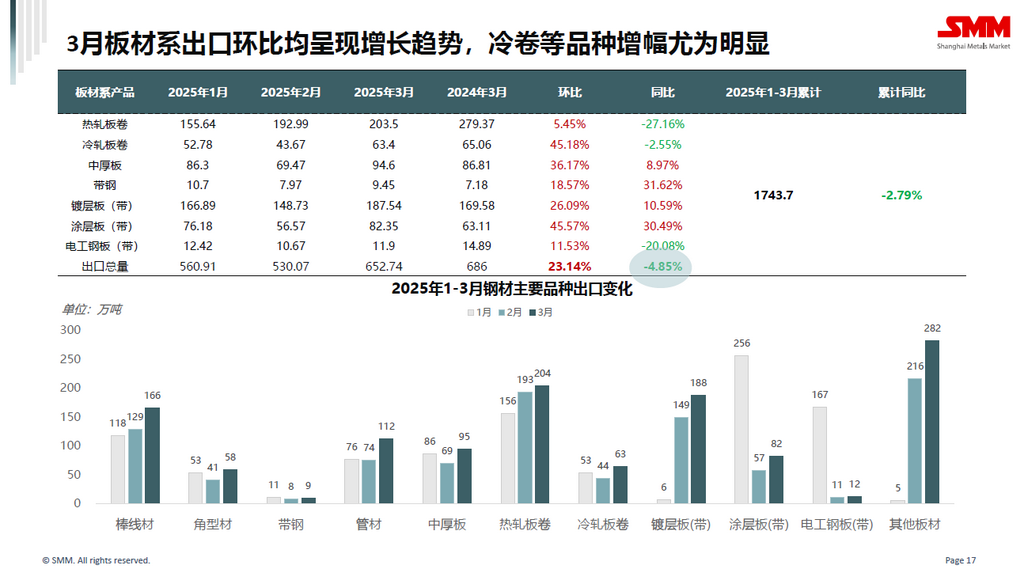

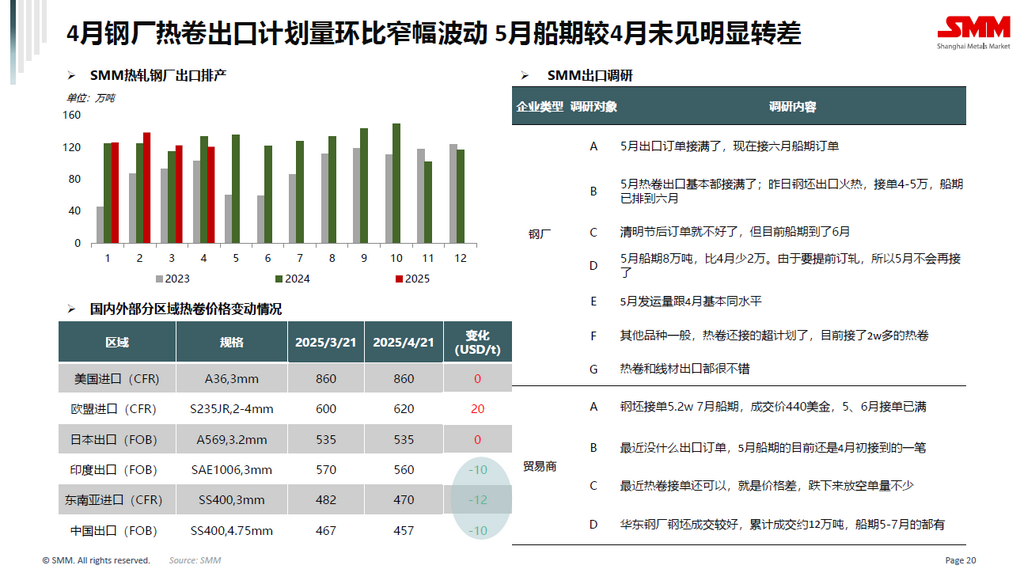

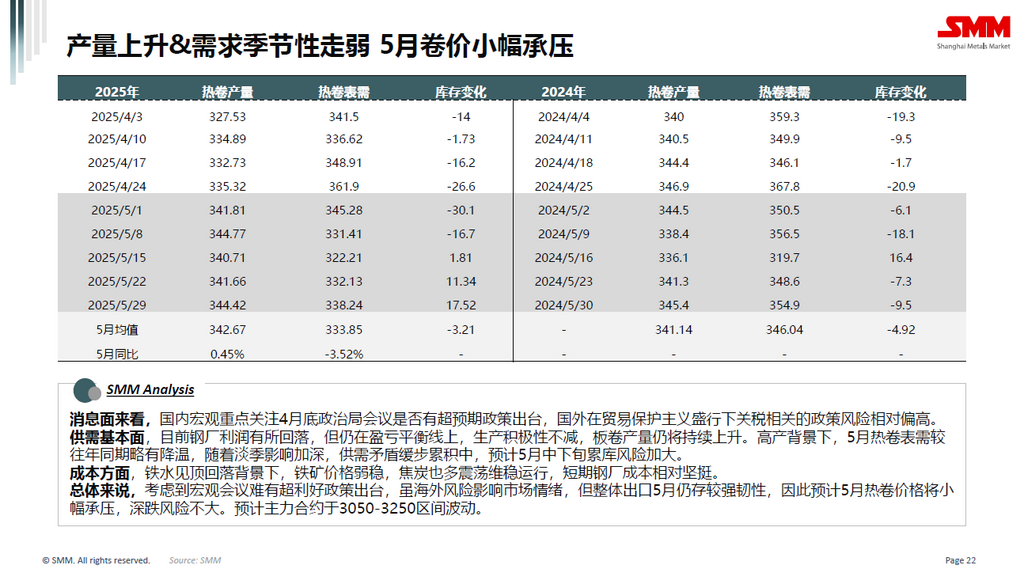

On the news front, domestically, the macro focus is on whether the Politburo meeting at the end of April will introduce policies that exceed expectations. Internationally, under the prevalence of trade protectionism, the policy risks related to tariffs are relatively high. On the supply-demand fundamentals, although steel mill profits have pulled back, they remain above the break-even line, and production enthusiasm remains undiminished, with plate and HRC production expected to continue rising. Against the backdrop of high production, HRC apparent demand in May is slightly cooler compared to the same period in previous years. As the off-season effect deepens, the supply-demand imbalance is gradually accumulating, and the risk of inventory buildup is expected to increase in mid-to-late May.

Cost side, with pig iron peaking and pulling back, iron ore prices are in the doldrums, and coke prices are also mostly fluctuating and stabilizing. In the short term, steel mill costs remain relatively firm.

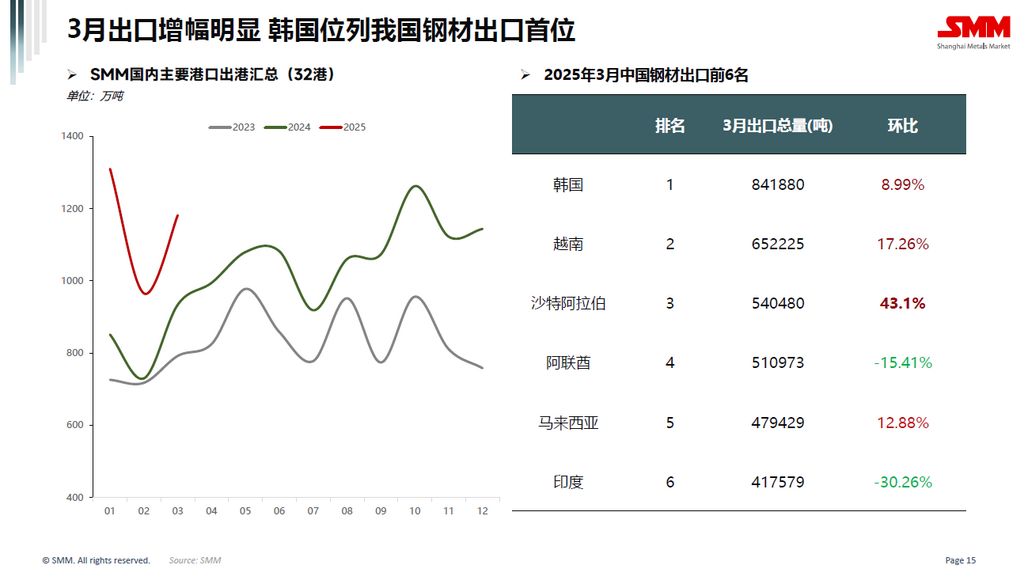

Overall, considering that the macro meeting is unlikely to introduce significantly favorable policies, and despite the impact of overseas risks on market sentiment, overall exports in May still show strong resilience. Therefore, HRC prices are expected to face slight downward pressure in May, with a relatively small risk of a deep decline. The most-traded contract is expected to fluctuate within the range of 3,050-3,250.

Data Source Statement: Except for publicly available information, all other data are processed by SMM based on publicly available information, market communication, and relying on SMM‘s internal database model. They are for reference only and do not constitute decision-making recommendations.

For any inquiries or to learn more information, please contact: lemonzhao@smm.cn

For more information on how to access our research reports, please contact:service.en@smm.cn

![The most-traded BC copper contract closed down 2.85%, as speculative fervor cooled, weighing on copper prices [SMM BC Copper Review]](https://imgqn.smm.cn/usercenter/CYktX20251217171711.jpg)

![The Black Industrial Chain Lacked Upward or Downward Momentum Before the Holiday [SMM Steel Industry Chain Weekly Report]](https://imgqn.smm.cn/usercenter/FRcmT20251217171746.jpg)

![The most-traded SHFE tin contract plummeted more than 8% in a single day, and tin prices are expected to remain in the doldrums in the short term [SMM Tin Futures Review]](https://imgqn.smm.cn/usercenter/LLUUJ20251217171751.jpeg)